The Gig Picture

Online platforms such as Uber and Upwork and Freelancer are shaking up the way many people work. And the media has taken to describing this space by several terms, including the “Gig Economy,” the “Sharing Economy” and the “On-Demand Economy.”

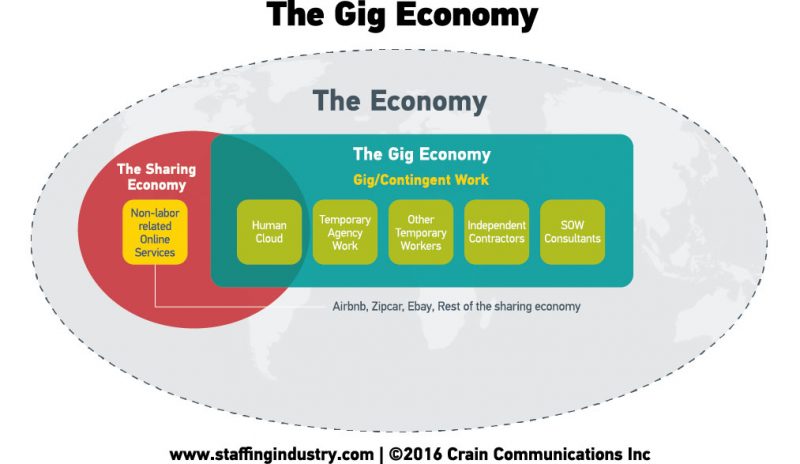

But the future of work includes more than just online staffing. Staffing Industry Analysts takes the view that a “gig” should not be defined narrowly to include only those types of work facilitated by way of an online process. While the media may have jumped onto the term, people have been working gigs way before the internet appeared. For us, the Gig Economy encompasses all forms contingent work — including temporary agency workers, other temporary workers, independent contractors, and statement-of-work (“SOW”) consultants.

Related: The Gig Economy and Human Cloud Overview

Some commentators would also include online services such as Airbnb and Zipcar as part of the Gig Economy. However, as these services are not labour-related, we regard these services as part of the Sharing Economy, but not part of the Gig Economy.

In defining this global market, we have also estimated the spend for all categories of gig (or contingent) work in 2015:

In defining this global market, we have also estimated the spend for all categories of gig (or contingent) work in 2015:

- Independent contractors, by far the largest category of gig work, represented an estimated USD 2.04 trillion in spend.

- Spend on temporary agency workers is estimated at USD 366.0 billion.

- Other temporary workers include those sources directly by user companies without going through a staffing firm. Total global spend for these workers was USD 610.7 billion.

- Gross revenue from “human cloud firms” fell somewhere between USD 25.55 billion to USD 28.60 on a global basis. While this makes it the smallest category by spend, this type of work is more lowly paid and contracts are for a shorter period compared to other contingent categories, therefore, the number of human cloud workers is much higher than the revenue estimate suggests. The human cloud includes online staffing platforms such as Upwork and Freelancer. It also includes “online work services” firms such as Uber, Lyft and Instacart that connect end users to workers that provide specific services, such as driving a car. And a third component of the human cloud is “crowdsourcing” where workers complete microtasks online.

- And finally, SOW consultants represented USD 458.0 billion in spend. While SOW consultants are typically, but not always, employed by consulting firms and given a regular, consistent salary by their employer, from a client perspective the work is wholly contingent in nature.

Adding all these categories together, the total estimated Gig Economy spend was approximately USD 3.5 trillion in 2015.

That is a big number, but it refers to all types of contingent work and in every country around the world. Well, that is with one important omission. The informal workforce (i.e. those normally working outside tax and regulatory policies) is not included in our analysis. While, arguably, such work is inherently contingent, by its very nature it is very difficult to measure. According to the International Labour Organisation, it comprises more than half of the global labor force and more than 90% of Micro and Small Enterprises (MSEs) worldwide.

It’s likely that spend on gig work will grow. In a separate report, we surveyed large companies that use contingent labor and asked what percent of their workforce is contingent now and what the percent will be in the future. The median response was that 20% of their workforce was contingent this year but that 25% would be in 2026.

We also asked about online staffing specifically, and it appears that staffing buyers are becoming more familiar with it. Only 3% of buyers said they used online staffing in 2012, and only 1% said they planned to use it within the next two years. However, for the 2016 survey, 13% said they use it, and 19% said they planned to use it within the next two years.

Recently, Staffing Industry Analysts held its Collaboration in the Gig Economy conference in Las Vegas to discuss trends in the overall Gig Economy and bringing together over 600 delegates from staffing firms, human cloud firms, contingent labour buyers and even a number of gig workers. Discussions included market trends, legal concerns (particularly with co-employment and independent contractors) and the landscape of services available.

Given the interest and growth in contingent forms of work, it is important that suppliers, buyers and governments can agree on common definitions so we very much hope our work in mapping out the global Gig Economy helps foster better understanding, better collaboration and better legislation.

The article was first published in the RCSA Journal December edition.

By

By